22 Mar Leaving A Legacy

As the oldest of nine children, I got the call first. My father, who recently celebrated his 97th birthday, needed help creating a list assigning his personal belongings to each of his children. He knew that his

real estate and financial assets would be distributed in equal shares, but there were other things, many charged with sentimental value, that would need to be passed on to one of his children – but to which one? My father’s request began a process of listing items – the furniture, the China set, the crystal, jewelry, even his extensive library of medical and scientific books he had collected over a 70-year career in medicine.

He decided to ask each one of us what we wanted from that list. And while this process ended up taking longer than he would have liked – the nine of us live in three different continents – it finally got done. I could sense a profound relief in my father after this process was over. He had a strong desire that, after his death, his children would remain close and conflict free: a lofty but attainable goal.

Because of this personal experience, I began raising with my clients even more often the importance of having a Legacy Plan in place. While it’s not an enjoyable task to prepare for our inevitable passing, it helps to know that this process allows us to be the decision makers.

So, how do we get started? For some of us, the work might already be done. We have completed our estate plan, we are constantly reducing clutter and keeping our belongings in good order, we have prepared a list of bequests, and we may even have planned our funeral. For others, it may be part of a to-do list, along with other important but not urgent items. Deciding how you want to put together your Legacy Plan is the first step. Some of these decisions are easier than others, but they must all be addressed sooner or later. A meeting with your trusted advisor can help you navigate the many decisions that must be made. Once you are clear on what you want, meeting with your legal professional is next. They can then translate your intentions into legal documents.

Going through this arduous but very important process allows us to ensure that our wishes will be carried out and our assets will be properly distributed after our passing. In many states, without the proper documents in place, an unintended distribution of assets can be ordered by a probate court. Not having a financial power of attorney prevents us from assigning the right person to act on our behalf when we cannot do so ourselves. Unless we periodically review our beneficiary designations, especially for those investments that bypass the will, we might end up leaving assets to the wrong parties.

Having served clients for almost 30 years, I understand the challenges of creating a Legacy Plan that not only covers the necessary legal documents but that also honors the core values and family traditions we seek to pass on to our loved ones. Over the years, I have heard countless stories from clients who reminisce and reflect on what their parents meant to them. In most cases, there is a deep appreciation for the monetary and emotional legacy they received from them.

As my dad approaches the evening of his life, I, too, feel an immense gratitude for all the ways he showed us his love, including his decision to plan for the inevitable in a mature and compassionate way.

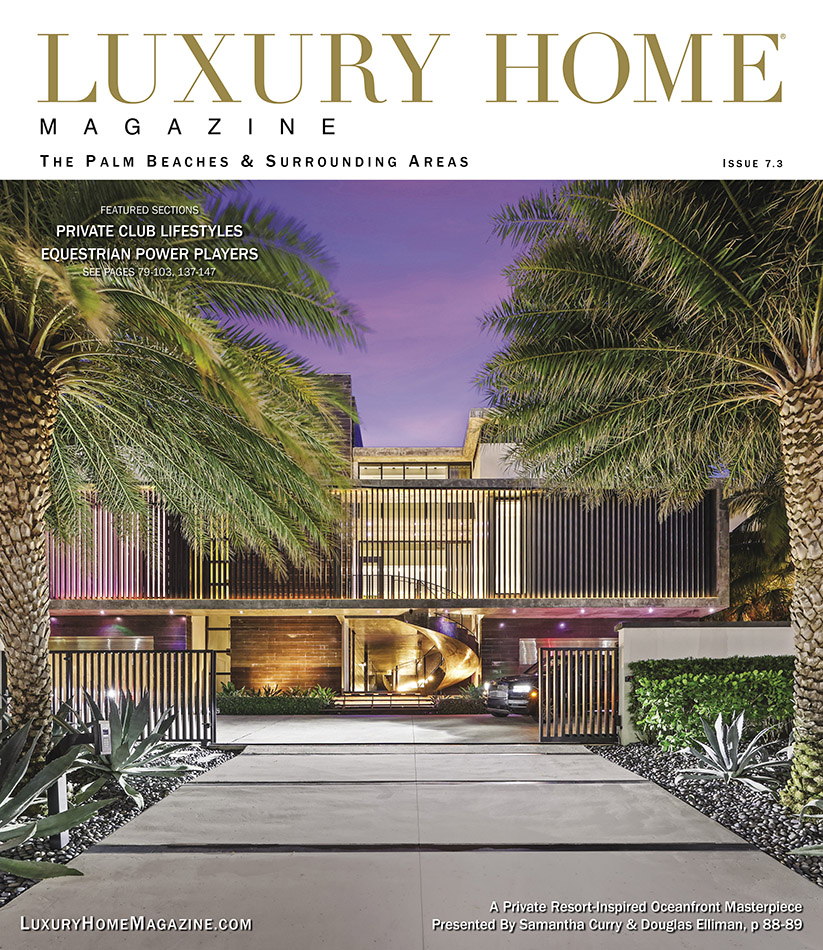

Visit Luxury Home Magazine of The Palm Beaches to search more available luxury real estate in South Florida.

You May Also Like…

-

-

Eastern Accents: Run for the Roses Collection

Gallop off into the sunset with Equestrian pillows for Eastern Accents, our tribute to the elegance ...

24 June, 2025 -

High Point’s Spring 2025 Market

A peek into new and noteworthy products debuting at High Point Spring Market ...

09 June, 2025